When you start to consider a loan or a line of credit, you must always weigh all available options before applying. To select the best personal loan or line of credit, you have to know the specifics of each offer.

Both personal loans and personal lines of credit can help in situations where you need to access to quick cash. There are however major differences in the timing and availability of funds.

What is a personal loan?

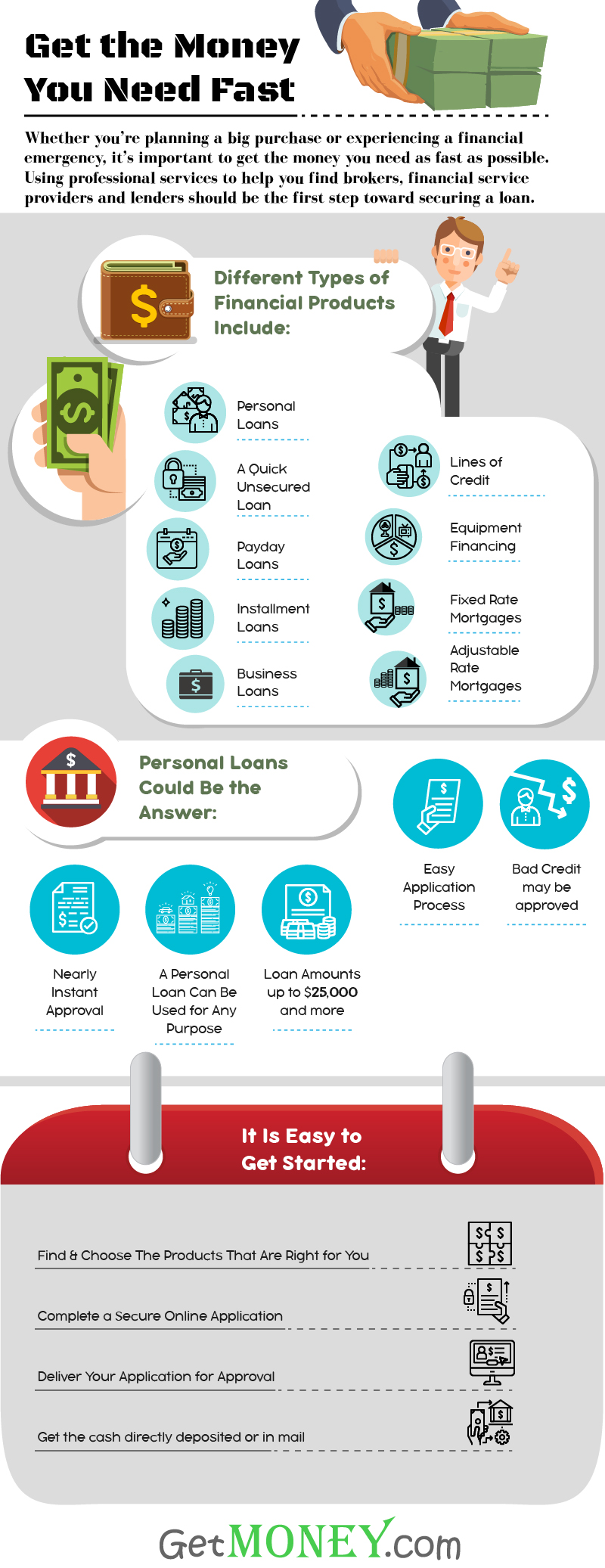

A personal loan is a fixed sum loan for a fixed period with fixed payments. Unlike specific purpose loans, such as business loans and auto loans, there are no restrictions as to what the proceeds of a personal loan may be used for. For example, personal loans can be applied towards a luxury purchase, emergency bills, or even for consolidating debt.

Personal loans are generally unsecured loans, and the lender has no recourse in case of a default. Thus, personal loans carry a higher interest rate.

The credit requirements for online personal loans are flexible and don’t require perfect credit. All credit types are welcomed.

Personal loans fund in as little as one business day, click here to get started.

What is a personal line of credit?

A personal line of credit is similar to a credit card and sometimes referred to as money on demand. You receive a specified amount of credit that may be used all at once or partially on multiple occasions up to your credit limit.

Your repayment process begins the minute you tap into the line of credit and draw against it. Payments are based on the outstanding balance, and the credit is revolving.

As you pay down the balance, the credit becomes available. These types of loans generally require excellent credit and are offered by traditional lenders and can take weeks to process a loan.

The right choice

For quick access to funds without going through multiple layers of scrutiny, a personal loan is the right choice.

Perfect credit is not required and the process is simple with online personal loans. Request a loan, get approved and the money is directly deposited in your bank account.

The best personal loans online fund in as little as one business day.

If time is not of the essence and you have time to deal with more traditional lenders and are simply looking for the security of knowing you have access to cash in the future, a line of credit may be the right choice for you.

Can I improve my credit score with a personal loan?

Yes, you can improve your credit with an online personal loan in several ways. For example, by consolidating debt into one loan can prove positive for your credit score.

In addition to that, some lenders report to the credit bureaus which will help establish a positive credit history. Click here to get a personal loan today.

With all that said, we strongly advise against getting a loan to simply rebuild your credit. It is much wiser to pay down your existing debt and develop a sustainable financial strategy for budgeting your monthly expenditure.

How can I get a personal loan?

It’s simple. Click right here and you’ll be directed to the personal loan page where you can request for a personal loan in 3 minutes with no obligations.