In today’s unpredictable economic climate, finding fast and reliable ways to access money can be a game changer. Whether you’re facing an unexpected medical bill, car repair, or need cash for a personal matter, quick cash loans or personal loans offer a potential solution for millions of Americans navigating short-term financial challenges.

Understanding Personal Loans: More Than Just Quick Cash

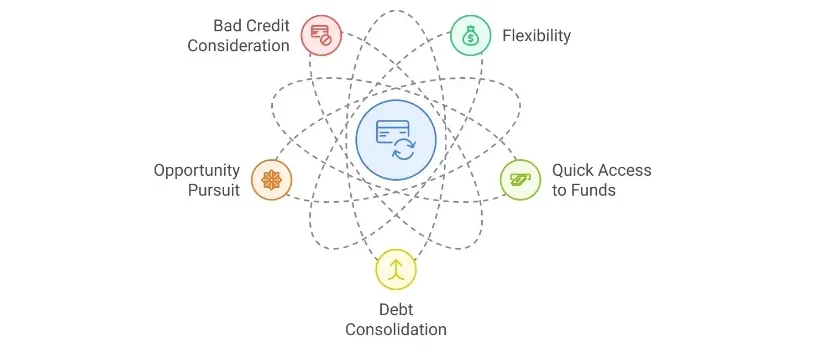

Online personal loans provide more than just quick money—they offer financial flexibility and strategic problem-solving. Let’s explore what you need to know about personal loans, especially if you’re dealing with bad credit or urgent monetary needs.

The Real-World Financial Squeeze

Did you know 40% of Americans would struggle to pay a $400 emergency expense? This startling statistic from the Federal Reserve underscores why quick cash loans and online cash advances have become essential lifelines for many.

Who Needs Quick Cash Loans?

Quick cash loans aren’t just for financial emergencies. They can be used for:

- Unexpected medical expenses

- Urgent home or car repairs

- Bridging income gaps between paychecks

- Consolidating high-interest debt

- Managing short-term financial setbacks

Most Commonly Asked Questions About Personal Loans

Yes! Many lenders specialize in bad credit personal loans, though interest rates may be higher. We recommend the article: fast-personal-loans-for-bad-credit-get-quick-cash-today

Lenders have varying credit score minimums, and higher scores generally qualify for lower interest rates.

Understand the potential consequences of late payments, such as late fees or penalties, by carefully reviewing the lender’s late payment policy. We recommend you read the article, “What Happens If You Don’t Pay an Installment Loan?“

Many online lenders offer same-day or next-business-day funding after approval.

Some lenders use a soft credit check for initial applications, which doesn’t impact your score. Only final applications trigger hard inquiries.

Yes! Many lenders specialize in bad credit personal loans, though interest rates may be higher. The network of lenders we work with at GetMoney.com, welcomes all credit types.

Navigating the Process of Getting an Online Personal Loan

Common Concerns and Misconceptions

Bad Credit? It’s OK—You Have Options!

Contrary to popular belief, bad credit doesn’t automatically disqualify you from getting an online personal loan. While traditional banks may have stricter requirements, many lenders specialize in personal loans for individuals with less-than-perfect credit. GetMoney.com welcomes borrowers of all credit types.

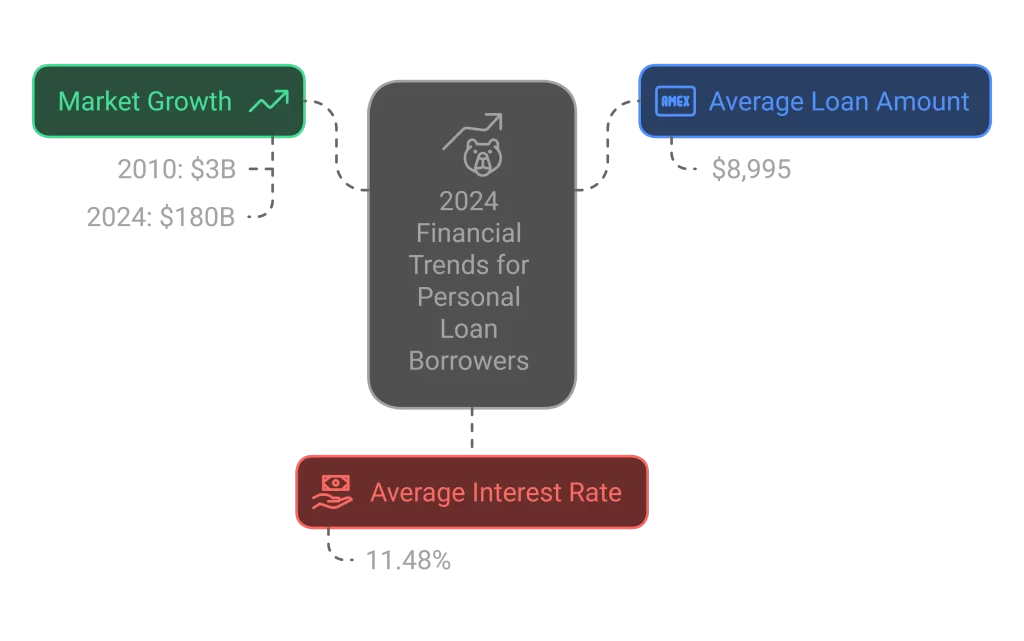

Understanding Interest Rates

Quick cash loans and online cash advances often come with higher interest rates compared to traditional bank loans. However, the context is important. When faced with an urgent expense, the cost of the loan may outweigh the consequences of not securing the funds you need.

| Loan Type | Approval Time | Credit Requirements | Typical Use Case |

|---|---|---|---|

| Payday Loans | Same Day | Minimal | Emergency Expenses |

| Personal Loans (Bad Credit) | 1-3 Days | Flexible | Debt Consolidation, Major Expenses |

| Online Installment Loans | 24-48 Hours | Moderate | Larger Purchases, Extended Repayment |

Eligibility: What Lenders Really Look For

To qualify for most online personal loans, you’ll typically need:

- Proof of steady income

- Valid government ID

- Active checking account

- Be at least 18 years old

- Basic contact information

Tips for Faster Loan Approvals

- Check Your Credit Report: Know your credit standing before applying. Address any errors that could negatively affect your score.

- Gather Documentation: Have pay stubs and bank statements ready to streamline the process.

- Compare Multiple Lenders: Shop around to find the loan that best fits your needs.

- Read the Fine Print: Understanding the terms prevents future headaches. Don’t hesitate to ask lenders questions about their terms.

Red Flags to Watch Out For

Warning Signs of Predatory Lending

- Upfront fees before loan approval

- Guaranteed approval without verification

- Extremely high interest rates

- Pressure to act immediately

- Unclear or overly complex loan terms

Smart Borrowing Strategies

Maximizing Your Loan Potential

Borrow Only What You Need

Carefully assess your financial situation and borrow only the amount necessary to address your immediate needs. Over-borrowing increases monthly payments, extends repayment terms, and adds unnecessary interest costs. We suggest reading our article about getting the best personal loans before you request a personal loan.

Have a Repayment Plan

- Factor in your monthly income and expenses.

- Determine an affordable monthly payment.

- Prioritize loan repayment to avoid late fees and penalties.

Consider Loan Consolidation for Better Rates

If you have multiple high-interest debts, consolidating them into a single personal loan with a lower interest rate can save you money.

Build an Emergency Fund for Future Needs

Creating an emergency fund is like building a financial safety net. Start small by setting aside a portion of each paycheck. Over time, these contributions can add up significantly.

Real-World Best Use of Personal Loans

Unexpected Bills: For example, using a personal loan to pay off two high-interest credit cards and cover unexpected medical bills. Consolidating these debts into one monthly payment can reduce overall expenses and potentially save hundreds of dollars each month while improving your credit score.

Use GetMoney.com’s free calculator to get a personalized estimate. This will help you make informed decisions about how much you can afford to borrow.

Recommended Resources

- Consumer Financial Protection Bureau

- National Foundation for Credit Counseling

- Federal Trade Commission Consumer Information

Disclaimer: Financial situations vary. Always consult a financial advisor for personalized guidance.

Ready to explore your online loan options? Start by requesting a personal loan today. Your journey to financial flexibility begins with understanding your choices.