Personal loans offer flexible financial solutions for working professionals seeking quick access to funds. Whether, you’re managing unexpected expenses, consolidating debt, or pursuing business opportunities, personal loans provide the means to navigate complex financial situations—even if you have bad credit.

What Are Personal Loans? Fast Cash Solutions Explained

Personal loans are simple. The borrowed money can be used for almost anything. Whether it’s an emergency or a planned expense, personal loans are flexible financial tools that give you the cash you need without the hassle.

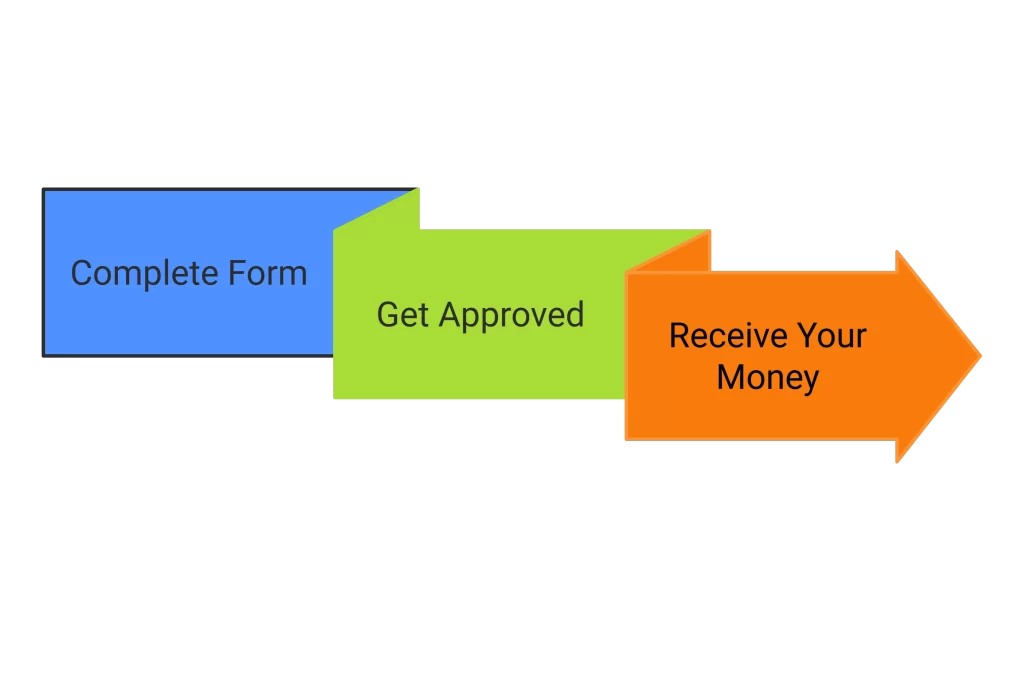

How to Apply for Fast Personal Loans: A Simple 3-Step Process

- Apply Online: Complete a quick online application—some take just minutes.

- Get Approved: Many lenders provide instant decisions or approve your loan within hours.

- Receive Your Money: Funds are deposited directly into your account, often on the same day.

Where to Find the Best Fast Personal Loans in 2024

Here are your main options for quick cash, depending on your needs:

- Online Lenders: Fast approvals and competitive rates.

- Peer-to-Peer Platforms: Borrow from individuals for more flexible terms.

- Credit Unions: Lower rates and personalized service.

- Banks: May offer streamlined processes for existing customers, but they usually take longer and require more documents.

Example: Sarah, a freelance designer, used an online lender to cover unexpected medical bills. The process was seamlessly done from the comfort of her house, and she received funds in her bank account the same day.

Personal Loans for Bad Credit: Can You Qualify?

Yes! Options exist for all credit scores:

- Specialized Lenders: Online lending platforms offer loans to borrowers of all credit types.

- Secured Loans: Offer collateral for better terms.

- Credit Unions: Flexible criteria for members.

Inside Tip: If you’re unsure about how much you can afford to pay monthly, and how much the loan will cost, try the GetMoney.com loan calculator to compare costs and monthly payments.

Why Choose Personal Loans? Key Benefits You Should Know

Flexible Uses of Personal Loans

Unlike car loans or mortgages, you can use personal loans for almost anything—consolidating debt, covering emergencies, or funding professional growth. There are no restrictions as to what the funds can be used for.

Fixed Interest Rates: Why They Matter

You know what you’re paying every month—no surprises.

Unsecured Loans: No Collateral Needed

Unsecured loans mean no risk to your home or car if you are unable to make the monthly payments.

Hidden Costs of Personal Loans: What You Need to Know

Be aware of these potential downsides:

- Origination Fees: Typically 1-6% of the loan amount.

- Higher Interest Rates: Personal loans can be pricier than secured loans.

- Late Fees: Missing payments can be costly—and harm your credit.

How to Borrow Smartly: Avoid Over-Borrowing or Under-Borrowing

Borrowing too much or too little can hurt your financial health.

Over-Borrowing Risks

- Higher monthly payments.

- Increased financial stress and limited flexibility with future purchases.

- Possible impact on overall credit.

Example: John borrowed $15,000 for home renovations but only needed $10,000. The extra monthly payments impacted his budgeting and delayed his plans for a family vacation.

Under-Borrowing Risks

- Missing opportunities to invest or consolidate debt.

- Slower financial progress.

Example: Maria borrowed less than she needed for medical expenses, resulting in higher costs when she had to apply for another loan later.

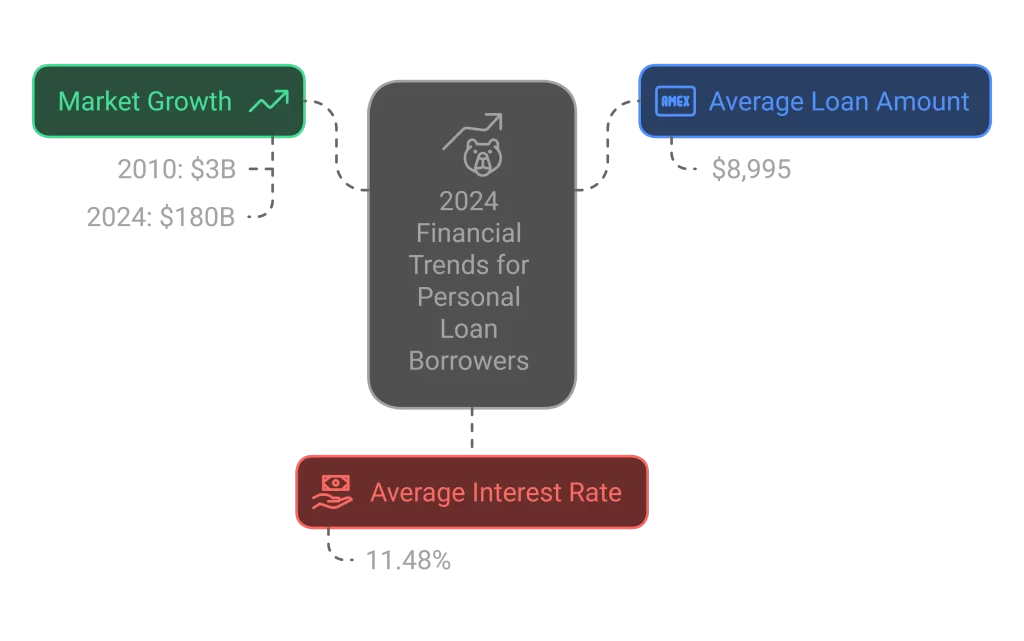

2024 Financial Trends: What Personal Loan Borrowers Should Watch

- Average Loan Amount: $8,995

- Average Interest Rate: 11.48%

- Market Growth: Online personal loans grew from $3B in 2010 to $180B in 2024.

Smart Uses for Personal Loans: Real-Life Examples to Inspire You

Debt Consolidation

Lower your interest rates and monthly payments by combining debts into one loan at a lower interest rate.

Emergency Expenses

Avoid credit card debt with a quick personal loan. Personal loans are usually less costly than credit cards.

Professional Growth (alternative to business loans)

Need that certificate for a promotion at the office? Finance the courses you need to advance your career with an online personal loan.

Example: Chris used a personal loan to pay for the courses he needed to complete for an AI certificate. The investment paid off when he landed higher-paying clients.

Red Flags When Choosing Personal Loans: Stay Safe

Watch out for:

- Hidden fees.

- Unclear terms.

- Aggressive lending practices.

How to Choose the Best Personal Loan Lender for Your Needs

When selecting a lender, focus on:

- Interest Rates: Look for competitive interest rates.

- Loan Terms: Ensure repayment terms align with your financial situation.

- Fees: Check for origination, late payment, and prepayment fees.

- Reputation: Read reviews and verify lender credentials.

Boost Your Credit: Tips for Better Loan Terms

Want better loan terms? Focus on:

- Paying bills on time.

- Keeping a low debt-to-income ratio. Reduce your debt-to-income ratio by paying down existing debts. Ideally, keep this ratio below 36%, as lenders often prefer borrowers with lower ratios.

- Monitoring your credit regularly. Check your credit report from all three major credit bureaus and look for errors or inaccuracies that could negatively impact your credit score. Dispute any incorrect information with the credit bureaus promptly.

Smarter Borrowing: Use a Personal Loan Calculator

Before committing to any loan, use online tools like this personal loan calculator to:

- Estimate monthly payments.

- Compare different amortization periods.

- Understand and compare total borrowing costs.

Fast Personal Loan FAQs: Get Answers Now

Late fees, credit score damage, and potential legal action. Contact your lender immediately to discuss options.

Late fees, credit score damage, and potential legal action. Contact your lender immediately to discuss options. We highly suggest you read what happens if you don’t pay an installment loan.

Research lenders, read the fine print, and avoid payday loans. Look for transparent terms and reasonable interest rates.

Many lenders offer same-day funding after approval.

It varies based on lender guidelines. Online personal loan options exist for all credit types, you need to aware of your situation and your options before applying for a personal loan. With that said, most lenders will require a 580 credit score.

Final Thoughts

Fast personal loans can provide the quick cash you need, but success lies in choosing wisely. Explore your options, calculate costs using online tools, and borrow only what you need.

If you need to learn about your rights when applying for consumer loans, including personal loans, we highly recommend visiting trusted resources such as the Pew Charitable Trusts at https://www.pewtrusts.org/ and the Federal Trade Commission’s Consumer Information page at https://consumer.ftc.gov/. These reputable organizations offer valuable insights, resources, and guidance to help you understand your rights as a borrower, and make informed financial decisions.