About GetMoney.com

A trusted source for online loans since 2003

What We Do

We simplify the loan process by offering secure online forms that are easy to understand and quick to complete. We never charge up front fees and our process is designed to be hassle-free with you in mind.

Our Services

Personal loans: unsecured personal loans, payday loans, and installment loans.

Business loans: working capital, term loans, merchant cash advances, equipment financing, business lines of credit, purchase order financing and more.

Leadership

The executives, associates, and advisers have all experienced economic booms and financial hardships. They understand the daily business frustrations and what it takes to strive in the real world. With that said, the leadership is focused on making capital accessible in as little time as possible for business owners and individual borrowers.

“We are an internet based service provider that prioritizes old fashion values,” The CEO.

Our Focus

We understand certain situations require quick access to money or capital for both personal and business expenses. All our services are fine tuned to provide a quick solution for your capital needs regardless of loan type.

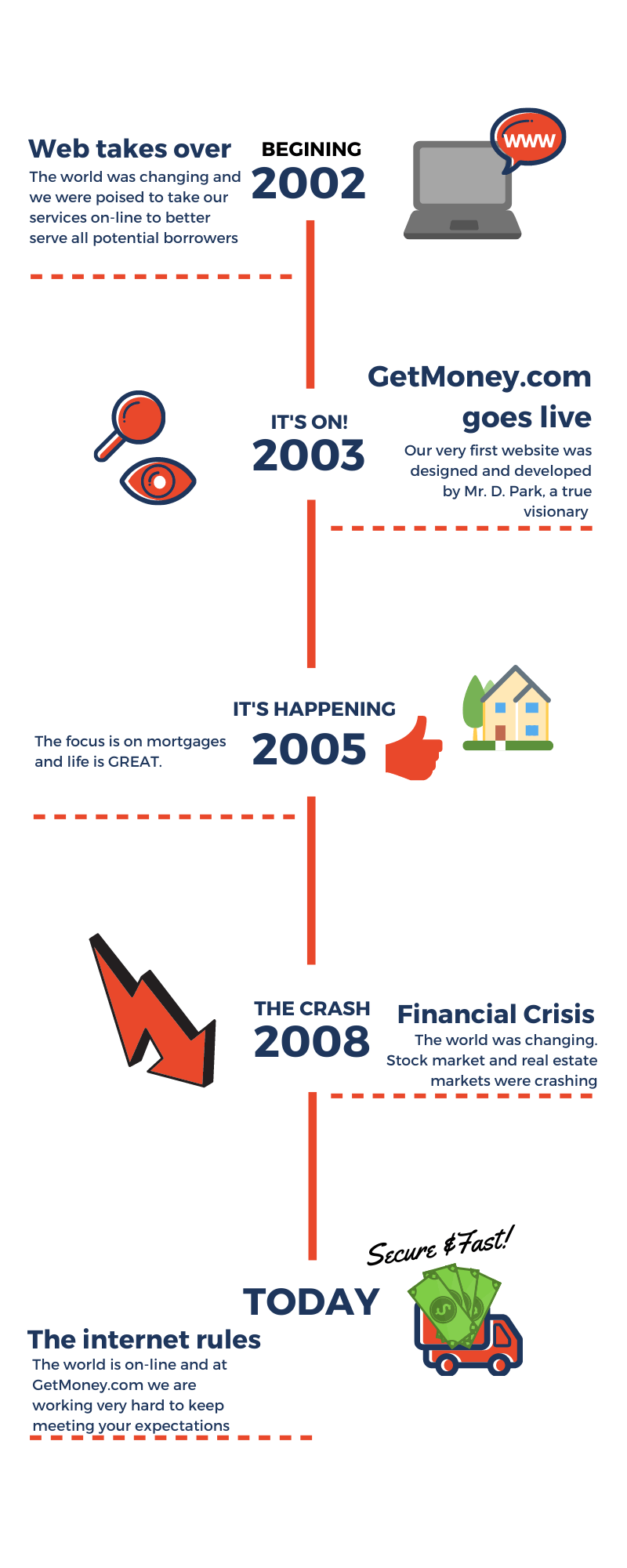

Our History

GetMoney.com began taking online mortgage and auto loan applications in 2003. After the 2008 crash, we shifted our focus towards non-bank business loans and personal loans.